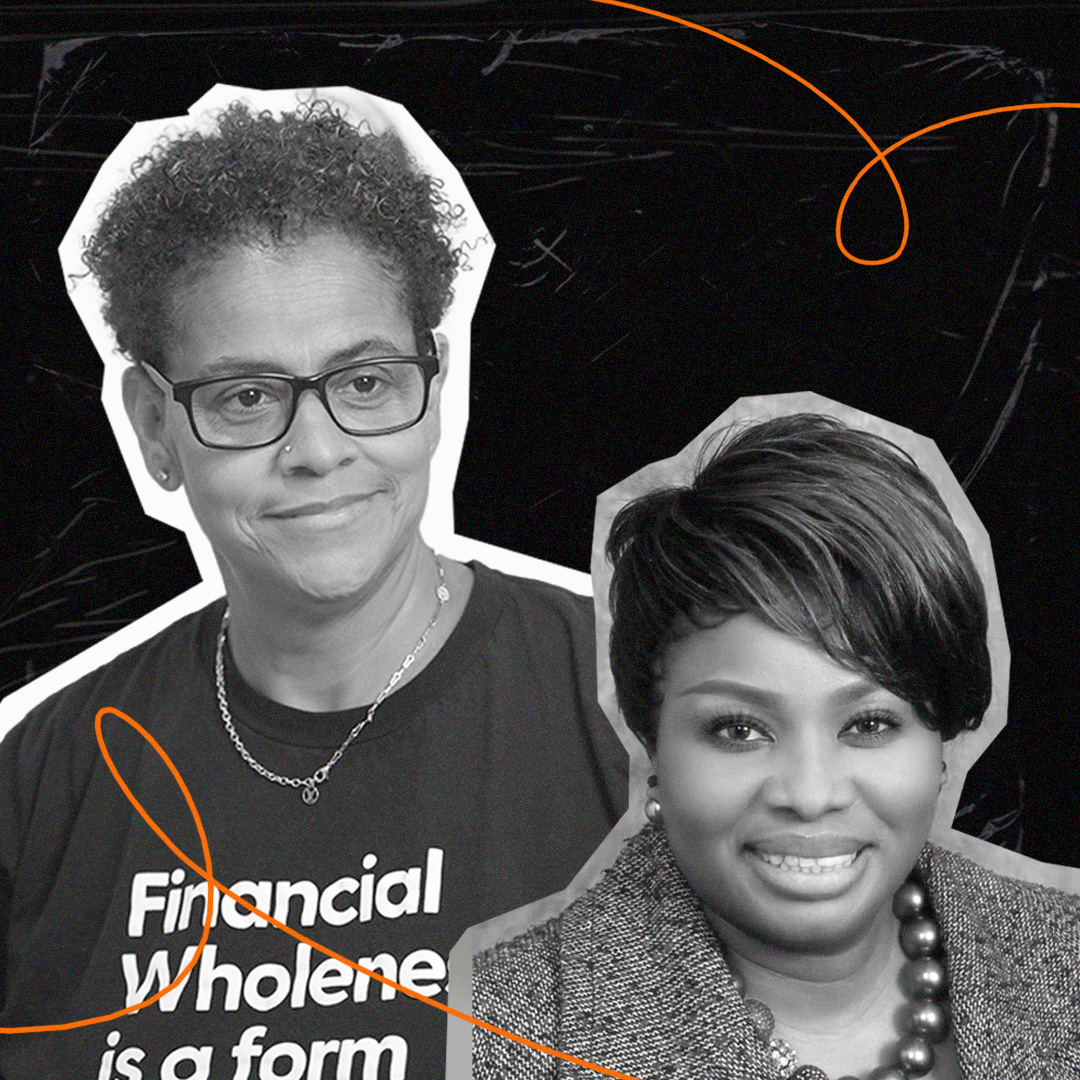

On today’s episode of Founder Hustle, Melissa Bradley is sitting down with MBallou Conde-Kouyate, the Vice President and Business Relationship Manager at M&T Bank. She defines herself as a frontline economic responder, and in this episode she answers all the questions that oftentimes we were afraid to ask. She lets us know that it’s okay for us to be transparent and to share what our dreams are, and to be honest at the forefront so that a banker is there not just to keep saying no, but to be partnering with us on our financial health check-ups on a regular basis.

About MBallou Conde-Kouyate:

MBallou is an accomplished financial service professional and a business strategist. Her career spans over two decades in leadership, management, and banking. She has experience working at two significant fortune 500 financial institutions and a minority-owned bank in the Greater Washington DC Metropolitan area.

Transcript:

0:00:05.7 Melissa Bradley: From Sermons Beyond Sunday and Kinetic Energy Entertainment, this is Founder Hustle.

[music]

0:00:11.1 MBallou Conde-Kouyate: Saying no is really hard. So every time I have to deliver a disapproval or a decline, that is a tough day for me. However, I have found ways to make it a maybe instead of a no with community partnerships with other organizations, community lenders. And I have some solid partnerships in my network where I am able to call somebody and say, “Hey, can we do this differently?”

0:00:38.3 MB: Yeah. Okay.

0:00:38.6 MC: And then offer an alternative and send the founders on a different journey while staying in the background.

[music]

0:00:45.8 MB: Welcome to Founder Hustle, a podcast series by, for, and about the new majority entrepreneur. I’m your host, Melissa Bradley, founder of 1863 Ventures. In each episode, I interview a new majority entrepreneur to create a safe space for them to be honest with you about their journey. These founders will redefine and represent the true definition of what it means to hustle and their stories will demystify, uplift, and educate anyone who is interested in the entrepreneurial ecosystem. As the general partner of a venture fund, I want to highlight the tools, strategies, lessons, and support systems that are the blueprint for becoming a successful entrepreneur. And shift your perspective on what it means to go from founder to CEO.

[music]

0:01:42.3 MB: Today’s guest is not a founder, but trust me, she’s extremely important to every single founder out there. MBallou Conde-Kouyate is with M&T Bank. And if you’ve ever been like me and it’s time to go to the bank, we all get a little nervous. Financial institutions have not been set up, particularly for founders of color, to make us feel comfortable. But MBallou will help us understand why and how we can build a trusted relationship with a bank. She also helps us go behind the scenes and look into that black box, so when we walk out of the bank, we know exactly what they’re looking for. And she also will tell us how we can have a successful as well as profitable relationship with your local financial institution.

[music]

0:02:30.3 MB: MBallou, I’m so happy to have you here. It has been a long time since I’ve seen you, so I appreciate you coming out for this conversation. Since I met you, you have been an advocate, a supporter, a connector, an honest truth teller for me, for my organization, and certainly for all the entrepreneurs too. This hopefully is not the last, but is one of many times that I wanna say thank you to you and thrilled to have you here today. I know you in all those roles, but also what are your official and unofficial roles at the bank?

0:03:00.0 MC: Thank you Melissa. I am so happy to be here and to see you in person. Well, I don’t tell about myself often, I’d rather talk to founders all day long, but let me take a shot at it. By functional title, I am Vice President and Business Relationship Manager at M&T. And in my role, I provide guidance and support to a portfolio of businesses, both for-profit and non-profit entities in Washington DC and Suburban Maryland Market. But from another viewpoint, looking at day-to-day of what I do, I see myself as a connector and advocate, ’cause I spend a lot of time advocating on behalf of our founders internally and also connecting them to my network and my resources.

0:03:48.1 MB: Okay.

0:03:48.6 MC: So I hope that gives you a pretty good idea. Okay.

0:03:50.9 MB: It gives me a great idea because I’ve had the privilege to experience that connection and advocacy for us and for the entrepreneurs. But I think it’s helpful because you’ve already started to shift what people’s perceptions are of a banker. ‘Cause oftentimes it’s not positive, they’re not smiling, they’re not happy. You mentioned that there is a lot of things that you do at the bank. Tell us how you got to the bank?

0:04:13.8 MC: Great question. I always had a passion for helping people, honestly. Before banking I was a retail store manager, so I handled so many client service issues. And for me, it was always a happy day to be able to take a client from an unhappy place…

0:04:32.1 MB: Sure.

0:04:32.4 MC: To putting a smile on their face. And then at some point, I selected banking, ’cause I thought that would be a great place to take my passion to ’cause… and there are issues there. [chuckle] And maybe a fun fact too about how I got there, my dad was a banker.

0:04:49.4 MB: Oh wow.

0:04:50.1 MC: Yeah. He was a banker in Africa, and he did manage the country’s biggest central bank, National Bank.

0:04:57.4 MB: Wow.

0:04:57.9 MC: So I grew up next to someone who valued community, helping people with all that title. He crossed the country and met with people.

0:05:06.9 MB: Wow.

0:05:07.0 MC: So when it came time for me to switch from retail to a different industry, I felt banking would be a great place to take my passion for customer service to.

0:05:17.8 MB: That is awesome. When you first went into retail was he disappointed saying, “What are you doing? Where is the bank? Help one, two, three?” Was he disappointed?

0:05:24.9 MC: Well, when I get to retail, it was for a strategic reason, first.

0:05:28.5 MB: Okay.

0:05:28.7 MC: ‘Cause I did go to a college in Canada, Montreal. So when I got to the US, my French was way better than English.

0:05:35.6 MB: Oh wow.

0:05:36.1 MC: So retail was a good opportunity for me to get into…

0:05:39.5 MB: Sure.

0:05:39.8 MC: Learning the culture, meet people and also perfect my English, ’cause I had my graduate studies in French. So that was an investment that…

0:05:50.9 MB: Sure.

0:05:50.9 MC: Was worth my while, honestly. But then when it came time to switch careers, I said, “You know what, I’ve been… I think banking…

0:05:57.9 MB: Yeah.

0:05:58.0 MC: Is really where I belong.

0:06:00.2 MB: You’ve been surrounded by it.

0:06:00.4 MC: Exactly.

0:06:00.5 MB: That’s awesome.

0:06:00.8 MC: Exactly.

0:06:01.5 MB: But in either way, you’ve picked two roles that are very much… Human facing, where people enter relatively consistently, obviously pre-COVID, and oftentimes don’t have good experiences, [chuckle] and not necessarily always because of the person on the other side of the table. So I guess, I would imagine there’s lots of days where you would have highs and lows for a variety of reasons, and so I’m curious, what is the best part of your job? And what is the hardest part of your job?

0:06:33.5 MC: Let’s start with the good one…

0:06:34.7 MB: Okay, yes.

0:06:35.2 MC: The best part of my day is telling someone, “You have been approved.”

0:06:38.3 MB: Yes.

0:06:38.8 MC: Honestly, ’cause you don’t get that all the time in many places. So that is the best part of my day, and also really… And getting to know people, their life stories, ’cause not everyone has the same journey. My journey doesn’t begin here, it begins in Africa, then Canada, then here, so you have to understand that, and embark on our client’s journey to understand where they are.

0:07:02.6 MB: Sure.

0:07:02.8 MC: So when I’m able to bring that journey to a certain point and to say, “You’ve been approved,” or, “Here you go, you can now make your dreams come true.” That’s a happy day for me.

0:07:12.6 MB: Right. Yes.

0:07:13.3 MC: The lowest day will be the opposite, I hate to say no, but you and I know that we cannot get everyone.

0:07:20.3 MB: I know that, yes. [chuckle] Yes.

0:07:21.1 MC: So saying no is really hard, so every time I have to deliver a disapproval or a decline, that is a tough day for me. However, I have found ways to make it a maybe, instead of a no, with community partnerships, as you know I’m always in the community.

0:07:40.3 MB: That’s right.

0:07:40.4 MC: I partner with other organizations, community lenders, and I have some solid partnerships in my network where I am able to call somebody and say, “Hey, can we do this differently?” And then offer an alternative and send the founders on a different journey while staying in the background, and wait until they reach a level where they’re attractive to banks again. So yeah.

0:08:06.3 MB: Sure. Yeah. I just wanna pause there, ’cause I would imagine anybody listening is going, “Okay, how do I get to MBallou ’cause I have never heard a banker say that,” but I just wanna say that is true. There are obviously lots of banks in the world, but I would say that having been in the financial services arena, and having been a bank regulator, so I’ve seen many banks, but I’ve never seen a person like you who is less committed to the outcome and more committed to the process. And I think that’s huge, because let’s be honest, a lot of people are afraid when they walk into the banks, right? In fact, statistics shows that black entrepreneurs are 37 times more likely to be afraid of even having a bank relation, because they presume they’re gonna be denied a loan, and 23 times that Latinx entrepreneurs feel that way.

0:08:54.0 MC: It could be intimidating.

0:08:55.2 MB: Yeah. And so I guess, what do you do? Because I have never heard any entrepreneur that has come to you say, “Whoa, I’m scared,” they’re scared before they call you, but after they go, “Oh, it was the best call ever girl.” What do you do to kind of change that, I’d say misperception, that a bank is a scary place to be?

0:09:11.7 MC: I really… Being me and keeping it simple. If I may begin with an example.

0:09:17.1 MB: Yeah.

0:09:17.9 MC: One of your associate, Ade, always reminds me of a day when an entrepreneur told him that I showed up at a birthday party from… For a prospective client, who wasn’t even an M&T client.

0:09:31.0 MB: That’s right.

0:09:31.8 MC: We showed up as that friendly banker that wanted to be here, just to get another glimpse of their life story. So Ade always reminds me that and that keeps me grounded. So those are the types of things I do. I really… I spend time getting to know the person in front of me beyond the numbers, ’cause that’s the best way to understand where they are and take them to the next level. And I avoid looking down on founders, ’cause most of the time, the ones that I meet have been elsewhere and they have been told no, or they have been made… They left feeling like, “I’m not even worthy of their time.” So regardless of the outcome, but I make sure that first interaction is important, and that they feel like we understand exactly what’s important to them, and really putting them on a pedestal. Even if I wasn’t looking at a perfect financial picture. That makes it a lot easier.

0:10:39.2 MB: And that’s important, because again, having been a regulator, I think the perception is that bankers make decisions based on finances.

0:10:46.3 MC: Yes.

0:10:46.7 MB: But you all assess risk on a much broader scale, and I would say, seek to mitigate risk. And particularly you, in very non-traditional ways, in terms of just spending time with the entrepreneurs. So I wonder if you can tell the audience, right, because we often times walk in, we walk out, we don’t know what happens when you all go in those back rooms, and we don’t know what happens when we hit submit on paperwork. How do banks go about assessing risk?

0:11:12.8 MC: Great question. So before I answer your question, maybe I can define a little bit what risk is?

0:11:18.5 MB: Please, yeah.

0:11:19.3 MC: For the… In layman’s term. Risk is really the potential or the possibility of something bad to happen, right? We all take risks every day from leaving our household to going back.

0:11:31.7 MB: That’s right. Certainly, getting into a car these days.

0:11:33.4 MC: Exactly. So we have car insurances, life insurances. So for banks, it is the same way, we have to assess risk, and really decide what type of risk appetite to take. So when it comes to founders, there are several ways to assess risks, but let me particularly focus on lending risk assessment.

0:11:54.7 MB: Yeah, perfect.

0:11:55.0 MC: A simple way banks do that is really review the five C’s of credit. I don’t know if you’ve heard of it, but I’ll go over quickly. And the first C is Character, second C will be Capacity, third C is Capital, and the fourth and fifth C’s will be Conditions and Collateral. So let’s look at the first two C’s, Character and Capacity. While character looks at the applicant’s past performance, capacity will look at present and future performance. So we pull credit to look at cycles and the business profile, that would give us a pretty good indicator of what type of risk we’re taking there, or we could tolerate, or how much appetite we can express in that particular application. We look at how previous financial obligations have been handled, so that would be for a character. For the capacity analysis, with regard to risk again, we will look at current performance, cash flows, projections, how’s the business doing, and what the picture looks like.

0:13:05.6 MB: Sure.

0:13:05.8 MC: In a short and long term, you know, that would also give us a good idea as to if we wanna do this deal or not.

0:13:12.4 MB: Okay.

0:13:12.8 MC: Capital has to do with the equity that the applicant can bring to the table, you know, cash equity. Of course, banks love to know that you’re bringing something to the table.

0:13:23.4 MB: Absolutely shared risk. That’s right.

0:13:24.6 MC: Definitely.

0:13:25.3 MB: Yeah.

0:13:25.4 MC: However, if you don’t have it, we could utilize the SBA route to mitigate that.

0:13:30.8 MB: Yeah.

0:13:31.0 MC: So, you know, we’re not just saying it’s too risky.

0:13:33.5 MB: Sure.

0:13:33.7 MC: So we have mitigating areas. And the last two Cs to assess risk if I wanna finish in that line is the conditions and collateral, collateral, meaning do you, you know, does the applicant offer anything to fall back on whether it’s a liquid asset or property asset, you know, to pledge for the loan. And lastly conditions, really meaning, does it make sense. When we look at economic and contingencies, but banks do take different appetite.

0:14:06.1 MB: Sure.

0:14:06.4 MC: But I can say that when the founder is not in the room, you have someone like me.

0:14:11.8 MB: Thank God.

0:14:12.3 MC: That still continues to speak for you.

0:14:14.2 MB: Thank God.

0:14:14.9 MC: And bring forth all the mitigating factors or attenuating circumstances that there may be so.

0:14:23.4 MB: Right. Or just so… And that part is probably the most important. So I wanna come back to that, but…

0:14:28.0 MC: Okay.

0:14:28.1 MB: When you think about the five Cs and I’m a finance person, so I’m trying to… I appreciate the layman’s terms.

0:14:32.5 MC: Ah [laughter] great.

0:14:34.1 MB: Are those finite numbers, right? Or is that really like a sliding scale? How do you evaluate those?

0:14:40.8 MC: I think it is a sliding scale.

0:14:42.4 MB: Okay.

0:14:42.6 MC: ‘Cause, it’s not the same for everyone.

0:14:44.2 MB: Right.

0:14:44.6 MC: Yeah. It is a sliding scale.

0:14:46.3 MB: And I want… I was hoping you would say that because I think… We are finding more that our entrepreneurs are laser focused on their credit scores.

0:14:53.9 MC: Mm-hmm.

0:14:54.1 MB: Which unfortunately they are what they are and there’s all kinds of things you can do to boost and change them. But, they are a data point and I think it’s important that you were able to say there’s four other ways, at least that you are looking to create a fuller picture of that person beyond that score. It’s kinda like when folks get ready to go to college. Right. And they’re like, what’s my SAT score. The reality is there’s no admissions officer who just looks at that score. It’s what did you write in your essay. And in your case, your essay is what did you think when you spend time with them? So I hope that for those who… Although I will admit, I felt overwhelmed by the college process as well, but there are… It’s not just a number. It is about a relationship. And so with that, you know, I have…

0:15:33.2 MC: Absolutely.

0:15:33.6 MB: I personally, I haven’t experienced it, but you know, you hear back in the historical lore that there were these like community banks, right? Where everybody knew everybody, and they hang out. Beside you, is that notion long gone that like your banker actually knows who you are, like, do you think with consolidation? And I mean, we’ve had the highest rate of entrepreneurship during COVID.

0:15:57.3 MC: Mm-hmm.

0:15:57.5 MB: Are there enough banks to get this kind of attention?

0:16:01.2 MC: I don’t think that idea has been long gone.

0:16:03.8 MB: Okay.

0:16:05.3 MC: I don’t think that, you know, I guess from the world that I’m in…

0:16:08.3 MB: That’s it for you, and you know better than I.

[laughter]

0:16:09.7 MB: That’s why I was like, you know of some other ones you let me know now.

[laughter]

0:16:13.4 MC: Yeah. And specific for M&T where I work, we really consider ourselves not a community bank actually, but the bank for communities.

0:16:24.0 MB: I like that.

0:16:24.5 MC: That’s how we say it.

0:16:25.3 MB: Oh, good.

0:16:25.4 MC: The bank for communities. And during COVID we looked at ourselves really as a first-line economic responder. And we did that very well.

0:16:37.5 MB: You did. You were the largest PPP lender in the country.

0:16:41.9 MC: Number one.

0:16:42.3 MB: I believe, Yeah.

0:16:42.9 MC: And we did. We did. And we were able to do that because of the fact that we believe wholeheartedly in the fact that we are the bank for communities. Recently, I don’t know if you listen in the news, we just outlined $43 billion to support the communities. Which mean we’re gonna be approving more founders.

0:17:03.4 MB: Okay.

0:17:03.7 MC: You know, or put more money in programs like Beyond Five.

0:17:07.4 MB: Yeah, yeah.

0:17:08.3 MC: You know, and during COVID, again let me go back to that, while it hurts me to say that many founders didn’t even know where to get the information.

0:17:18.3 MB: That’s right.

0:17:19.6 MC: We as a bank really held enough webinar sessions.

0:17:24.5 MB: You did.

0:17:24.9 MC: And disseminated information to clients who were not even, I mean, to prospective clients who were not even ours to help them with their banks.

0:17:33.1 MB: Yes.

0:17:33.5 MC: And our site never crashed.

[laughter]

0:17:36.1 MB: That’s key. That’s key.

0:17:37.4 MC: Very important.

0:17:38.2 MB: Yes.

0:17:38.3 MC: Because many sites did crash.

0:17:39.6 MB: That’s right.

0:17:40.2 MC: Ours didn’t.

0:17:40.7 MB: That’s right.

0:17:41.3 MC: And then we were able in the end to distribute $7 billion.

0:17:46.4 MB: Wow.

0:17:46.7 MC: $7 billion in PPP loan.

0:17:48.9 MB: Wow.

0:17:49.2 MC: With 99% positive feedback.

0:17:52.5 MB: I love it.

0:17:52.9 MC: Yeah.

0:17:52.9 MB: I don’t think anybody gets 99% anymore so that’s…

0:17:57.4 MC: We did.

0:17:57.5 MB: That’s key.

0:17:57.5 MC: We did. And even… even when banks had to stop PPP funding, M&T still continued through the community lenders.

0:18:06.1 MB: Yeah.

0:18:06.7 MC: To share information with our people, to make sure that was done.

0:18:11.5 MB: Yeah.

0:18:11.7 MC: So yeah, I think that idea of the community bank is a commitment really for us. But again, another way to keep….

0:18:20.9 MB: Yeah.

0:18:21.3 MC: …you know, that community banking belief that we have at M&T. So I think overall we do a pretty good job…

0:18:29.2 MB: Yeah.

0:18:29.4 MC: …at taking M&T to the communities. So we are the bank for communities.

0:18:34.3 MB: I love that. And I’m gonna use that.

[chuckle]

0:18:36.2 MB: But, you need to call MBallou because she is for the community. And you have proven that. But you mentioned something that’s gonna lead me into this next question around how do people even start a banking relationship. But, you’d mentioned Beyond Five which is a research project that I’ve been working on to really look at black and brown entrepreneurs who’ve lasted beyond 5 years because most businesses, more than half of businesses in this country fail five years or less. But I realized two things that are relevant to this conversation. One is that black businesses are actually, their average duration is 8.3 years.

0:19:09.5 MC: Oh.

0:19:10.1 MB: The challenge of that though, which will lead me to my next question… is their longevity does not correlate to their growth. So most of them have been flat in their revenues enough to at least sustain themselves, but flat. And when we asked them, do they have a banking relationship and have they gotten a loan? Less than 50% said yes to a relationship, and think less than 40% said yes to a loan. I don’t wanna dive into why, but I wanna focus on the relationship piece.

0:19:42.3 MC: Okay.

0:19:42.3 MB: Because I think most of them, you know.

0:19:44.0 MB: I mean, growing up with my mom, the bank was a scary place for her. So it naturally became a scary place for me. How would you advise any entrepreneurs, or particularly Black entrepreneurs, who we know have experienced redlining and everything else, how would you advise them to form a relationship with the bank? Because they think too often, not to the bank’s fault, it’s a relatively transactional relationship – You take my money. You charge me for that. I’m trying to get it out. How do we start that relationship with the bank? How do we even know who to talk to when I walk in?

0:20:15.1 MC: A very good question. When it comes to building a relationship with a bank, I would say the most important thing I would recommend for an entrepreneur to consider, begin by shopping around, honestly. These days, especially in COVID time, you could literally go online and compare banks. And a good place to start is the bank mission statement. Mission and vision statement. ‘Cause we all have different vision and mission statements. But you want to…

0:20:44.1 MB: I love that.

0:20:44.6 MC: ..Definitely shop around and select the bank that has a vision that aligns with your own personal values. That is very, very important. And once you select that bank, it is important to have someone that you can call by name, to have a point of contact. Banking relationship is far beyond the 1-800 number that we all know exists everywhere.

0:21:09.1 MB: Right. And you wait on hold. And you hit a button. You never talk to anybody.

0:21:11.7 MC: But you have to be able to text a MBallou.

0:21:14.1 MB: Right. That’s right.

0:21:15.2 MC: As we know.

0:21:15.9 MB: That’s right.

0:21:16.7 MC: Or be able to walk into a bank and have… So once you pick that bank, ask… wonder if there is a business relationship manager.

0:21:26.1 MB: Gotcha.

0:21:26.9 MC: Yeah, ’cause that is important. If you have that, I think, in addition to the vision statement of the bank aligning with your values, I think that would be a good way to form a relationship. ‘Cause you have to have a point of contact. ‘Cause that person will be your ally.

0:21:42.1 MB: Gotcha.

0:21:42.5 MC: Would be your advocate, as I said earlier, and will be your connector to the internal partners. Because it’s many departments that come into play when it comes to really delivering all the services that an entrepreneur might need. And you need that person inside the bank to be able to advocate for you and connect you to the remaining professional teams that are behind the scene.

0:22:08.1 MB: Yep.

0:22:08.8 MC: Yeah.

0:22:09.2 MB: So there’s two things there that I would say. I think we know a lot of entrepreneurs are racing sometimes for the wrong reasons to venture capital. And it’s a similar thing, that they’re looking at who these people are. And we always encourage people to do due diligence on them. But it’s just like what you would do to us, like you want to know what our mission statement is. So what I’m walking away with is we should diligence our banks the same way entrepreneurs go to try to find somebody to invest in them. We wanna spend time with that person, which leads me to three takeaways. One, we’ve got to invest the time.

0:22:42.0 MC: Yes.

0:22:44.1 MB: Two, it’s …we have to make sure that we spend time with the people. Because we may say, “Oh, they were great on the first day.” But that doesn’t mean, like you said, that your relationship manager is gonna make sure you get to the right person. And the third thing is, don’t just call you when we need you. Because it is gonna take time to build relationships.

0:22:58.2 MC: That takes time.

0:23:00.3 MB: But I will say for us certainly, and for our entrepreneurs, when we have needed you, you have always, always been there. Which leads me to COVID. I think it clearly… I’m not ready to say “It’s over,” despite everybody walking around and getting on planes. But it was detrimental to a lot of communities, and I think particularly to black communities. Because we didn’t have relationships. And we weren’t prepared. I think because there’s such a fear around us raising money, we don’t always have the audit readily available. We don’t always have our year-to dates. We haven’t always revenue checked or closed out our months like we’re supposed to from an accounting perspective. What did you learn during COVID about businesses and particularly Black businesses? Because we just don’t know what’s gonna happen now. I mean, it’s just Pandora’s box is open.

0:23:45.7 MC: We learned many things, sadly. When COVID came, it really sent a shock wave through the entire system. With that, we all learned many things. For us as a bank, surprisingly we learned to work differently. To work differently, definitely, we had to actually be… To come up with innovation to try to still service our clients at large. And then with that, we actually looked through every department and mobilized about a thousand people from every department just dedicated to the PPP loan funding.

0:24:27.1 MB: Wow.

0:24:27.6 MC: But we also learned not to take our clients for granted. ‘Cause COVID also allowed for opportunities for people not to consider new jobs, new banks.

0:24:36.9 MB: Sure. That’s right.

0:24:37.9 MC: So how well you were there for your client would determine how long they will stay with you. How much you demonstrated that you cared.

0:24:46.3 MB: That’s right.

0:24:47.0 MC: So we really learned to work differently and found new ways to get to them. We invested immensely in technology. Before COVID, most people had to walk into a bank to open an account. So now we have found new ways to open bank accounts via WebEx, via other means. But we really learned to work differently and be there for our clients.

0:25:15.8 MB: And so innovation is one takeaway that I think is relevant for the bank and for entrepreneurs. You saw a lot of entrepreneurs, I know, of all different sectors, races, ages, genders. What are a couple of takeaways you would have for them. Because knock on wood, whatever, what it is, COVID doesn’t happen again. But I think it certainly exposed all of us to the vulnerability of significant pivot changes in our business models or our supply chain. So what advice would you give to entrepreneurs post-COVID that would help them next time, if there was some kind of big impact on our work?

0:25:53.8 MC: One thing I would definitely advise is don’t wait until you need a loan to apply for it. You have to… To get it in place for just in case. And during this COVID, I think the people who were able to weather the storm longer than anyone are the ones who already had something in place. So I would say definitely consider a safety net of a line of credit to have in place, but I would also say, keep a schedule, a routine, of meeting with your banker, ’cause when something like this happen, you wanna be dealing with someone who already knows you, who knows where you have been. Quarterly is the perfect picture. But I would say once a year, meet with your banker to go over your short and long-term plans and to go over the prior year, just like we do with our doctors every year, I think with that…

0:26:51.8 MB: With your health checkup.

0:26:52.1 MC: Exactly.

0:26:52.3 MB: With your financial health check-up.

0:26:53.6 MC: Yeah.

0:26:53.8 MB: I like that.

0:26:54.3 MC: Yeah, those two.

0:26:56.1 MB: I like that.

0:26:56.3 MB: And I would imagine, just like you mentioned in those five C’s part of that character, is that if you haven’t heard from me, you don’t know what I’ve been going through. But if you’ve heard from me particularly in a good way, as you all move to create more technology, that relationship becomes even more paramount, I would imagine.

0:27:14.3 MC: Correct, correct. And on the opposite, and if your bank is not calling to check on you for having not heard from you, maybe that’s an opportunity to start looking.

0:27:23.8 MB: Yeah, interesting. Well, you will check on us. So that’s good, ’cause I appreciate that.

0:27:27.8 MB: Not only did COVID happen, but we have the death of George Floyd, which sparked I think a lot of focus in a good way and a little concerning late way, on black and brown entrepreneurs, but black entrepreneurs in particular. What has M&T done, or was it even doing before in the name of racial equality?

0:27:51.1 MC: A very good topic. Racial equality is definitely a conversation that’s happening, and I’m not just talking for M&T here, I belong to various groups, discussion groups, in addition to my experience with the founders. It is here. It has been here before George Floyd but it took George Floyd for all of us to kind of hit a pause button to say and reflect. And for me personally, I kind of felt that knee on my neck in various ways, personally… In many ways. So it’s always in the back of my mind, so I don’t take for granted things that I have access to or things that I could share with others and do for others. So at M&T around the George Floyd time, I have to say, we had already begun having conversations around issues like this. The bank really does a good job at creating an environment for us where we feel we belong and we are included. That begins with our diverse affinity groups. Before George Floyd we had various affinity group, the LGBTQ+ was one affinity group, the African-American, the Latino, the Hola group. I think right now we have about nine, but it started before George Floyd. So that sets a foundation for people to look at each other, you know differently… And say, You’re different from me. But we’re all here, let’s exchange.

0:29:28.1 MB: Yeah.

0:29:28.6 MC: So I have to say that it’s something that had helped our atmosphere. Now, after George Floyd, I think as a bank, we did a good job at moving beyond the conversation and take some actions. One thing we mentioned here is our Multicultural Banking and Community Affairs department that was created after George Floyd. ’cause we recognized that beyond the conversation, actions need to be taken, and I sit on the board of the Multicultural Banking…

0:30:01.6 MB: Of course you do. Thank goodness. I feel better already.

0:30:05.3 MC: And… And we just released our very first multicultural competency training for everyone in the bank to take, including our executives. So that was new after George Floyd. So just to give you an idea of how the conversation has happened and how we have been able to put some action behind it. One last program I could mention is our equity one, which is a mentorship program that happened also after George Floyd, where we’re paring employees or management levels with senior executives to exchange. So that’s also going on. So there is room for improvement, but from groups that I belong to, and I have to say, many women of colors, and I am one, and I have to say that I feel like in many places we’re still portrayed as consumer of things instead of creator of things, so there’s room for improvement within every organization, but I can say that where I am right now, I’m in a good place ’cause I can observe…

0:31:12.6 MB: Sure.

0:31:13.1 MC: The things are changing and actions are happening beyond the words…

0:31:16.3 MB: Yeah. I wanna pause it on that for a minute because I think the response that you just shared, it kinda gave me chills a little bit because I think we have seen a lot of commitments by companies post-George Floyd, and they seem very temporal in nature. But really what you’ve laid out just in terms of the mentorship piece and holding the institution accountable are huge, not just for you all, but I think this ebb and flow, and I would say, kind of riddled with friction relationship that most people have with banks out of pure fear is a big deal.

0:31:53.8 MB: As we talk about this need for people to have access, capital and this being able to save and creating assets and wealth, I think it’s significant, because we know that median wealth for black Americans will be zero by 2053, it’ll be zero for Latinx communities by 2073. And if we do not – and I will be the first to say all banks have challenges – but if we do not relate and connect with banks as an anchor institution the same way we do with our Civil Rights institutions, it’s gonna be hard for us to kind of create any kind of wealth. Because when I say homes or home-ownership is one of the biggest drivers of wealth creation, but ideally you don’t get one loan from a non-bank ’cause then it’s hard money and it’s outrageously priced and it’s too expensive, and there I just, I’ll be the one that say shady. So having this banking relationship is really important, not just for entrepreneurs in their business, but how do they just create wealth for themselves.

0:32:52.1 MB: And I think, you know, people too often define wealth by what we have. When we talk about this number, really, it’s like the median net worth of these communities. And what’s significant is that if the black and brown communities to be zero, right now, the median net worth for all Americans is $121,760, and that is a measure of overall financial stability. So it takes into cash, investments, property, as well as debts, etcetera. And so it means that on any given day, if I wanted to buy something, if I’m a non-person of color, American, I typically have access to $121,000 plus, but in a matter of time, 20 something years, right? 30 years, the black community is gonna have zero to pull from, which is kind of scary. And so what does that mean that people should be doing with their bankers right now? What kind of planning should we be doing?

0:33:50.2 MC: Again, even more important why you should have a point of contact, a banker, you meet frequently with, it really, really means that it’s important to educate ourselves and really take actions. Wealth is… I mean, wealth doesn’t come and knock at anyone’s door.

0:34:09.8 MB: I’ve been waiting a long time, girl, but it ain’t coming. You’re right.

[chuckle]

0:34:12.1 MC: You have to get up and go, create it. Part of creating it is really finding ways to scale your business. As I said, it takes a village to raise a child, but it takes a network to scale a business. And I think business ownership is one sure way to create wealth. And we should work with entrepreneurs, especially of color, to help them, support them in creating more businesses, more sustainable models to ensure that that median number grows and not get to zero.

0:34:49.5 MB: Goes to zero. Right. That’s pretty hard to recover from.

0:34:51.9 MC: Yeah.

0:34:52.2 MB: It’s interesting, it brings me to the point, if I may, because you had the good fortune of having a father who was a banker. So I would imagine that maybe not all dinner conversations, but a fair amount, were about finances. And that’s not the normal conversation, I mean, families of color usually talk about survival and what’s happening, and building community and taking care of other people, and very rarely as I’m learning from entrepreneurs, they talk about entrepreneurship, and oftentimes, they don’t talk about finances. But we’ve been talking in the context of businesses. What’s some of the best advice your father gave you around managing money and building wealth?

[chuckle]

0:35:24.5 MC: To really be hard on myself. One of the lessons he had taught me, even though being a banker, I think I never had huge pocket money.

[laughter]

0:35:37.5 MC: I had to learn to budget from a… You know, [chuckle] from a very, very small pocket, even though, knowing that… I mean, we’re talking Africa, but I’m happy to say that at least we were considered middle class at that point, so he could afford to do certain things for me. But I learned very early to really budget from a very small pocket. So that’s one lesson I learned, ’cause he strongly believed that wealth is not measured by what you spend, it’s by what you keep.

0:36:09.5 MB: Amen.

0:36:10.0 MC: He taught me that very, very early on. So by the time I hit Canada alone in North America as a student, I had already learned to budget under very hard circumstances. So that was one lesson. And another lesson he had taught me was also not to see myself as a woman. He actually hated when people say, “Behind every great man, there’s a great woman.” He hated that. He always said, “Well, next to a great man, there is a great woman.”

0:36:44.3 MB: I love that.

0:36:44.8 MC: So I’ve seen myself that way from an early age.

0:36:49.8 MB: Yeah.

0:36:50.1 MC: So I believe with that, it gave me the courage and the opportunity to kind of always challenge myself and think of ways of doing things differently and advocating for myself also.

0:37:05.3 MB: Yep. Well, I’m glad you advocate for yourself, ’cause I know you always advocate for all of us, that’s for sure.

0:37:09.9 MC: And my clients. Mm-hmm.

0:37:13.0 MB: So I love what you said, that wealth is measured not by what you spend, but by what you save. I think that’s significant because I know a lot of people walk around with some highfalutin, fancy stuff on their bodies thinking that that exemplifies wealth, but it does not. Talk about how that manifests with a small business owner. How does a small business get wealth, in terms of using that amazing phrase?

0:37:36.2 MC: Oh, thank you. I didn’t know it was an amazing phrase.

[chuckle]

0:37:39.0 MB: It is.

0:37:39.3 MC: But I strongly believe in it as a banker, even from growing up, from humble beginnings. So when I said that wealth is measured by not what you spend, but what you keep, what you save, is very important for entrepreneurs. Because first of all, you’re trying to create a business, and you don’t want expensive spending or spending that don’t make sense get in the way. When I talked about the C’s of credit, one of them is capital. Banks wanna know that you have something. It could be… For some, it’s this little. For some, it’s this huge, depending on the request.

0:38:20.4 MB: Right. It could be under 1000 or over 100,000. It depends on the request. Yeah, no, absolutely, absolutely.

0:38:24.8 MC: Let me put a number on it.

0:38:26.0 MB: Yeah.

0:38:26.2 MC: Like, for SBA lending, for term loans, you’re required to put down 10%.

0:38:30.5 MB: Gotcha. Okay.

0:38:31.2 MC: 10%. And for regular conventional loans, bank loans, if I may say non-SBA loans, you’re required to put down 20% or more.

0:38:41.3 MB: Gotcha.

0:38:42.3 MC: What if you haven’t saved anything? How can you afford that? So it’s much more important to save than to spend when it doesn’t make sense.

0:38:52.6 MB: Sure. When we were putting this together, I was like, “We have to have a banker,” because I think that there is more myth than reality.

0:39:00.6 MC: Thank you for having me.

0:39:01.5 MB: I couldn’t think of anybody else who I think would be brutally honest, but also practices what I think we need bankers to be, which is in the community and talking to people. And like you said and I’m gonna use, “a frontline economic responder,” because I think certainly when we talk about Black communities, we need frontline economic responders all the time, because we’re trying to undo all of the stuff that we have endured. And I think to your point, even when people may not always get a yes, that you’re working for them. Putting aside whether somebody gets a loan or not, how do you know when you’re successful?

0:39:41.2 MC: Well, many ways, but one particular way I know that I am successful is from meeting a particular founder, entrepreneur. From that moment, seeing that particular relationship follow any advice or use any services that I present.

0:40:02.6 MB: Yeah.

0:40:02.6 MC: And see them reach the next level. I think that’s the… How I know that I have been successful. I love examples, so I’ll give you one.

0:40:10.7 MB: Yeah.

0:40:11.2 MC: I met a young lady from Ghana, and I know you go to Ghana, Melissa.

0:40:14.4 MB: Yes.

0:40:16.1 MC: I won’t say their name here, but for years, they had been selling from their car, the trunk of their car, go to churches. And now, in this pandemic time, wanted to have their first brick and mortars. So we sat down, went through a pitch deck, business plan, discussed ideas, and we were able to have that funding and have the brick and mortar doors open this year.

0:40:42.8 MB: Wow. Wow.

0:40:44.7 MC: So…

0:40:45.1 MB: Let’s just pause on that. That’s pretty phenomenal, right? First of all, to go from your car to a brick and mortar, and then go to a brick and mortar during COVID.

0:40:54.3 MC: Yes.

0:40:55.0 MB: Wow.

0:40:55.7 MC: Yes. So that’s the kind of examples that I can… That’s the kind of example I can cite here as a way of me knowing that I’ve been successful to at least make that story possible. Another way for me to know that I have been successful is when I look at our SBA approval numbers, ’cause I don’t see the SBA chart, in terms of digits.

0:41:18.2 MB: Gotcha.

0:41:18.7 MC: Every time I pull that report, I could tell you, it’s like I have a film in front of me.

[laughter]

0:41:25.0 MC: ‘Cause I can see faces and moments in my mind that tie it to those same numbers I’m looking at.

0:41:31.5 MB: You know the inputs in the report.

0:41:33.1 MC: Exactly, exactly.

0:41:34.1 MB: ‘Cause they were the people, your clients, yeah.

0:41:36.8 MC: So, for 2019-2020, and I would say for the past 13 year in a row, we have been number one SBA lender in DC, Baltimore, Philadelphia, New York, and that’s not easy. So when I look at that, it reminds me, or it makes me at least acknowledge for a moment that I’ve been successful here, ’cause it takes a lot to be on the leaderboard of that kind of reporting. And lastly, when I think about how do I know that I have been successful, is when I tell the entrepreneur it takes a network to scale your business. Count me in as part of your network.

0:42:20.6 MB: I love that. I always say that entrepreneurship is a team sport, and on a regular basis I’m like, “I’m glad MBallou is on our team.” That’s all I have to say. You just mentioned the SBA, the Small Business Administration, and so I don’t wanna lose that because, again, I think there is a myth around who qualifies for it and who gets it. So tell us a little bit about the program. And you all are on the leaderboard. How’d you do that? And how can entrepreneurs be ready for that?

0:42:45.1 MC: You have to look at the SBA as a co-signer for banks to give loans to businesses that otherwise wouldn’t have been approved, based on their own merits.

0:42:58.6 MB: Gotcha.

0:43:00.0 MC: So we utilize that as a mitigating factor, as a collateral source. Sadly, when I met with entrepreneurs or founders, most have been told I swear that they don’t qualify for SBA.

0:43:12.1 MB: That’s right.

0:43:12.7 MC: I don’t have an answer for that ’cause I don’t know why they would be told that.

0:43:17.0 MB: Sure.

0:43:17.5 MC: But I do know that at M&T Banks, when you’ve met with us and we assess what you need, if the SBA is the route, we will select that.

0:43:26.2 MB: Gotcha.

0:43:26.4 MC: So, the SBA brings co-signature to a loan, and when there is an opportunity, we will use it. Now, the paperwork is huge.

[laughter]

0:43:37.5 MC: That could be a deterrent for many lenders, but it actually takes more time to work on a small SBA loan for me than book a million-dollar loan, honestly.

0:43:49.7 MB: Wow. So it’s gotta be the commitment of the bank, who’s interested.

0:43:53.2 MC: Once you’re committed to the process, or to the person in front of you, to their life story.

0:43:58.6 MB: Yeah.

0:44:00.3 MC: Then you won’t see the paperwork. So yeah, the SBA is definitely a tool we do not hesitate to utilize and help our founders get loan. ‘Cause if we don’t, many would be declined ’cause they won’t get it on their own merits.

0:44:16.2 MB: And I don’t know about anybody else listening, but I’d rather have M&T as a co-signer than my sister or my cousin.

[laughter]

0:44:21.3 MB: Who I have to look at Thanksgiving or Christmas dinner. They’re going, “You gonna pay me back?” So I love that. But there’s something there because… I tell entrepreneurs all the time, make sure you have a solid financial model for your business and a solid business model for your business. And you just alluded to something because, at some point in time in those models that we create, we have to allow for opportunity costs. We have to allow that something may take more time, but the return is gonna be outstanding. You just said something that I would admit, I didn’t know…which is it takes you longer to apply for an SBA loan than it does for a loan of a much larger size. So if that’s it, why do you do it? ‘Cause most banks or most people would not do something that takes longer for a less ROI.

0:45:07.6 MC: It has to be done. It has to be done. Anything that involves government, it’s paperwork.

0:45:13.0 MB: Yep.

0:45:13.2 MC: So that’s a known fact.

0:45:14.7 MB: Yeah.

0:45:15.1 MC: But you have to move beyond that and really be there to help. If you are safe, your sense of service is to really make sure we all keep moving the dial for people in our communities.

0:45:29.8 MB: Yeah.

0:45:30.2 MC: Then you should not hesitate about the SBA. So it’s really the paperwork time, but it’s still the best program out there. And we use it. We use it. It’s there for banks to use.

0:45:41.3 MB: Absolutely.

0:45:42.6 MC: ‘Cause the SBA, of course, backed by the government does not lend to individuals directly.

0:45:49.5 MB: That’s right.

0:45:49.7 MC: It’s done via our channels. So if we don’t utilize it, how can it get in the hand of the most vulnerable?

0:45:57.3 MB: That’s right.

0:45:58.0 MC: So, well, we just do not hesitate. It’s just a way of doing business.

0:46:02.0 MB: I love it. And you are number one in it.

0:46:03.5 MC: When it most applies.

0:46:04.6 MB: Everything that you’ve just outlined, I would say, and you alluded to it, but I would argue is probably 50-60% more than your job description, ’cause you’re going above and beyond. And I know I personally have texted you, and called you all times a day, and you always respond, which I am deeply grateful. What brings you joy?

0:46:26.1 MC: At the end of the day, I think my job really keeps me on my tiptoes. That brings me joy ’cause it’s always constantly moving, and it really keeps me grounded, and makes me stay on a forward thinking mode at all times. So that really brings me joy at the end of the day. If I can say also personally, my two daughters and my husband. As I am here today, my daughter is driving for the first time to school alone.

0:47:00.9 MB: Oh. I’m praying for her.

0:47:02.1 MC: I’ve always been…

0:47:03.0 MB: Okay. Alright.

0:47:03.9 MC: Got her driver’s license two weeks ago. My youngest one, so I’ve been praying driving here that she makes it okay.

[laughter]

0:47:11.1 MB: I know, that’s right. Well, we gonna keep praying too.

0:47:13.4 MC: So family brings me joy, definitely at the end of the day. And also my community partnerships. And that begins with you, Melissa. I can’t thank my community partners enough, ’cause they allow me to reach out beyond the four walls of my office and go meet founders, entrepreneurs, people everywhere of every background, and demystify the bank and say, “Hey, we could do something here.” So those are the three things.

0:47:44.6 MB: I’ve asked you a lot of questions, but you work with founders every day. Anything that I didn’t ask you that you think they should know?

0:47:52.0 MC: Well, you’ve asked me pretty much everything, but if I may, I will probably advise founders to learn early on to separate personal from business.

0:48:04.3 MB: Amen.

0:48:06.1 MC: ‘Cause that’s an area that I see an opportunity. I see many cases where you don’t really distinguish business expense from…

0:48:12.8 MB: Sure. Sure.

0:48:13.2 MC: And that’s…

0:48:13.5 MB: You’re just happy to have money. Come on now, you just… [laughter]

0:48:17.1 MC: You have, early on, no matter how small the business is, to have a separate checking for your personal and business. Your finances, the same way.

0:48:25.7 MB: Yeah.

0:48:25.7 MC: And as early as you can, put business expenses on a business credit card instead of a personal credit card.

0:48:33.4 MB: Yeah.

0:48:33.6 MC: ‘Cause you start building data. You start building a record for your business. But when it’s all commingled, then you get to the bank…

0:48:42.9 MB: And they can’t tell.

0:48:44.3 MC: We can’t tell. And then you don’t score high on the character, see, ’cause things have been so commingled.

0:48:51.4 MB: Yeah.

0:48:51.7 MC: So I would say really separating personal from business early on. I would say also learn a little bit about credit. If you have a bank today that offers webinars, great. If not, look around. Some of the banks have a great business education tools and online classes that you could take.

0:49:12.7 MB: Sure.

0:49:13.0 MC: ‘Cause the better you know, the better prepared you are.

0:49:16.4 MB: Yeah.

0:49:17.3 MC: And the easier it makes it for you to connect with a banker and make that connection for your business and keep a good record. Lastly, if I may add again…

0:49:30.3 MB: Please.

0:49:33.5 MC: Really organize the financial data also. It doesn’t matter. Even if it is 10,000 revenues that you’ve had, have the receipt and the record and the reporting in proper format. I’ve had situations where, when you ask for record, you get a phone picture of a document.

0:49:54.6 MB: Well, back in the day, you’d probably get a shoebox of receipts. So there you go. Yes.

0:49:56.3 MC: Get that. Go to Kinkos. I’m not endorsing Kinkos here.

0:50:00.8 MB: Sure. Sure.

0:50:01.8 MC: Scan stuff, have them ready.

0:50:04.0 MB: Being organized, though.

0:50:04.8 MC: When you establish your business, have those EIN documentation on a PDF. Ready. You could do that even on the phone.

0:50:13.0 MB: Right.

0:50:13.4 MC: So all that really would help.

0:50:15.6 MB: But let’s not be naive, our businesses are run by individuals. How does an entrepreneur manage? What can we tell folks? I have a business relationship, I have a bank account, you’ve given them some amazing tips. I worry now, though, that we’ve had this conversation that their business well-being is gonna be better off than their personal well-being. So how do they manage and navigate their personal financial relationship with their business banker? Should they have an account at the same place so that you can see that? Can they talk about personal with business and business… ‘Cause I realized these financial check-ups, we gotta make sure the owner is healthy as well. How do you advise people to kind of get their personal financial health in order?

0:50:56.1 MC: I am smiling ’cause I so love this question. In my world at M&T, I know you’ve known me, but I have introduced many folks to my branch partners. So it’s not just a business relationship manager you’ll meet at M&T, so if I can just focus on what we do.

0:51:16.2 MB: Yeah.

0:51:16.6 MC: On my team, I work with… I oversee about three branches in the DC area, Georgetown, L Street, and Good Hope. Those branch managers have the ability to work on home equity lines of credit, mortgages, life insurances.

0:51:33.0 MB: Gotcha. Okay.

0:51:33.3 MC: Some of them have their license in health and health insurance. Yeah. Some… Most of them. So our branch partners in the retail banking side…

0:51:45.5 MB: Gotcha.

0:51:45.8 MC: Are the ones that can also bring that personal care side to the equation. So oftentimes… Before COVID, now we do it via WebEx, but before COVID…

0:51:57.4 MB: Sure.

0:51:57.9 MC: After I met with a founder, my very next appointment, I’m bringing a branch manager to join the conversation.

0:52:04.1 MB: Sure.

0:52:04.3 MC: To go beyond the business conversation and also explore things on the personal side. ‘Cause sometime, there may be issues on the personal side… Or opportunities on the personal side that can impact the business side.

0:52:18.7 MB: Sure. So gimme a top line. What should they know about credit?

0:52:22.9 MC: I would say even the first C alone.

0:52:26.0 MB: Okay.

0:52:26.1 MC: ‘Cause sometimes, some may be surprised as to what’s in their credit and some may be very surprised. Actually many, many are surprised. “Well, I thought this was a business loan. Why are you pulling my personal credit?”

0:52:40.7 MB: Gotcha.

0:52:41.2 MC: So by learning just about the first C, I would say by half of the time, you’ve already positioned yourself for a positive outcome.

0:52:49.6 MB: I love that.

0:52:50.1 MC: Yeah. ‘Cause then you’re gonna begin managing your personal credit and your business credit profile differently.

0:52:57.2 MB: Yep.

0:52:57.3 MC: And not think, “Oh, my personal doesn’t matter.” You might have a great business credit’s profile, but your personal credit might get you declined for a business loan.

0:53:06.7 MB: It’s hell in the hand basket, which I would say is probably… I would say respectfully a pretty common thing amongst our entrepreneurs. Right? Because if you statistically, 76% of Black-owned businesses, 77% of Latinx businesses, and 75% of Asian-owned businesses are using personal savings, if they have any, and you have everyone over 10% to 12% who are using a personal credit card.

0:53:29.3 MC: Yeah.

0:53:29.9 MB: Because that’s our first line of offense in starting a business. And so you’re just kind of robbing Peter, I hate to say it, but to pay Paul. But the credit score thing, you talked about technology. I think too often people assume technology is gonna do things for them. It just enables things I would say to happen faster and hopefully have a better outcome, because the data is right there. But I watch that so many entrepreneurs don’t know their credit score. And I will say, when I was working in California, came back, there had been some weird things, because tax-wise, I got this thing in the mail that said, “You didn’t pay your taxes.” And I’m like, “What are you talking about? That’s my employer’s job.” And they had never changed me not being in DC to California. So it looked like I owed in both places. And then all of a sudden that was just… I would say a ripple effect, but it felt more like a wind storm of how my credit had changed. And I pulled my credit report and I was like, “What the hell?” And it took me two years, because there were things on there I didn’t know, wasn’t aware of, that had been logged wrong, that I had paid it off.

0:54:34.0 MB: But I’ll be honest, in my paying it off from my college time, it had also gone to collections. But I ignored the collections note because I was like, “Well, I already paid it,” but the collections people didn’t know that, and it’s not up to the credit card. And then I had closed it, but didn’t understand what the difference of closing. I was like, “I don’t want it anymore.” And I was like, “Well, ain’t this some shit.” And I’m happy to say, but once I… I mean, it took me two years that I had people helping me like counselors. But once I did that, my score went up over 200 points.

0:55:04.4 MC: Wow.

0:55:06.3 MB: And I worry, because I would just boost it with these things. But boosting is only temporary. You really need to pull back the cover and say, “What?”

0:55:12.9 MC: Yeah.

0:55:13.2 MB: Because it literally is the alternative representation of you when you’re not there. And as much time and care as so many of us put into how we look and how we show up, our credit report is just as important.

0:55:26.1 MC: It is. It is. And I wouldn’t change anything from what you said. I think your example is… I would say is a blueprint of what I would recommend any entrepreneurs to really do or start taking steps towards.

0:55:43.0 MB: Yeah.

0:55:43.9 MC: Very, very, very important. What I can add to that is also transparency. You have to be transparent. Know that your relationship manager or your point of contact at the bank should know everything. Numbers are numbers.

0:55:56.2 MB: Even if it’s not good.

0:55:57.7 MC: Even if it was not good.

0:55:58.9 MB: Yeah.

0:56:00.0 MC: Because it’s much easier to get in front of it…

0:56:01.3 MB: Yeah.

0:56:01.7 MC: ..than come around to try to explain it.

0:56:04.5 MB: Yeah.

0:56:05.2 MC: Numbers are numbers, like you uncovered things you didn’t know.

0:56:08.3 MB: That’s right.

0:56:08.7 MC: But by watching it, you got to know what it is. But by the time, maybe someone in your shoes gets to me, it may not have been resolved.

0:56:17.8 MB: That’s right.

0:56:17.9 MC: Right. But you may have been aware, let me know that.

0:56:20.4 MB: Right.

0:56:20.8 MC: So we can discuss ways to present…

0:56:23.1 MB: No surprises.

0:56:25.1 MC: Exactly. It’s easier to include it because we don’t just submit a loan package. We do a background summary writing, we present strengths and weaknesses. We do like a SWOT analysis.

0:56:34.5 MB: I love it.

0:56:35.3 MC: You’re a professor. You understand.

0:56:35.8 MB: Yeah, yeah, I love that. Yes. I know what that is. You know what that is, but everybody else may not know what that is. So tell us what is a SWOT analysis and how should an entrepreneur going about doing it?

0:56:46.3 MC: Well, I can… Even before becoming a business banker, I get used to that model of analysis, SWOT, meaning your strength, your weaknesses, the threats and opportunities in your environment. It is such an important way to diagnose the business state of being and try to look at how to move forward.

0:57:11.8 MB: Yep.

0:57:11.8 MC: So as a business banker, the reason why I throw that in there is because I don’t just collect financial data and submit into a machine. A whole lot more goes into it. So in my writing of a background summary, I write it similar to a SWOT analysis. Where from my interview, my sitting with the entrepreneur collecting information, to be able to present a package with a full background summary that talks about the business history, its strengths, its weaknesses, what are the opportunities that I see and what are the threats?

0:57:52.3 MB: Sure.

0:57:52.4 MC: Whether legal or just the business model.

0:57:55.3 MB: Sure.

0:57:55.8 MC: So it is important for entrepreneurs to start already thinking in that model. From the SBA website, by the way, there is a great template of a SWOT analysis.

0:58:06.8 MB: Love it.

0:58:07.3 MC: With key pointers for you to answer. And when you answer the questions, the analysis is done right there.

0:58:15.5 MB: Oh, wow.

0:58:15.9 MC: So, and that would make your conversation with your banker a lot easier.

0:58:19.8 MB: Sure. Sure.

0:58:20.2 MC: Yeah.

0:58:20.4 MB: It’s funny because I spend a lot of time with entrepreneurs as well. And I always tell them to do a SWOT analysis, but I say don’t just do it for the business, do it for yourself.

0:58:27.7 MC: Do it. Yeah, absolutely.

0:58:28.7 MB: And you don’t have to share with anybody. But this is a long game, and it’s important to do that on a regular basis, part of our financial health checkups because the opportunities and threats are gonna change. I mean, certainly everything changed with COVID and now as the world reopens things are gonna change. So I love that, that the SWOT analysis is both a tool that you use to kind of help advocate, but a tool that businesses and business owners should be using to just kind of do their own little financial health check-ups in between.

0:58:55.6 MC: Absolutely, absolutely. And it allows you to kind of scan around the… The entrepreneurs and their project and be able to speak more effectively for them inside your organization. We do stuff like that…

0:59:08.3 MB: Yeah.

0:59:08.3 MC: So I’d rather slide into those areas and present it and be able to defend it in front of an underwriter and say, “Oh, I’m aware of that… ”

0:59:17.1 MB: Right.

0:59:17.6 MC: As opposed to, “Oh, they didn’t tell me that. ”

0:59:20.1 MB: Got you, makes sense.

0:59:20.9 MC: So I would say, be transparent with your banker…

0:59:23.6 MB: Yeah.

0:59:23.6 MC: Put everything on the table.

0:59:25.3 MB: Yeah.

0:59:25.4 MC: Good and bad.

0:59:26.2 MB: Yeah. I just wanna say how helpful that is because I do think, even for myself when I started my first company, I had my personal over here, my business over there, and they were in the same bank, but it was clear they were not talking to each other. And so it just… It really goes back to what you started out by saying, is that our entrepreneurs need to do due diligence on who our partners are, particularly if they are financial partners because there’s so much that rests in your hands in a good way that really can help propel the business. And I think it just reinforces what you started with, which is you need a bank that’s for the community, for sure. And that community is those who are business owners, those who are taking care of their kids, those who are head of households. And that we cannot be ignorant about the fact that when we show up as business owners, particularly in the world of banking, you’re still looking at us as a person.

1:00:18.5 MC: Yes.

1:00:18.8 MB: And we need to make sure that our house is in order.

1:00:20.9 MC: By having a team of bankers where you not only have your business banker, but you have access to a branch retail manager, to an insurance advisor, which we have via our M&T Insurance Company. You really do get, through those consultations either yearly or throughout the year, things will come up where we will address business concerns, but also address the personal side.

1:00:50.9 MB: Yeah. So that’s a perfect way to close this out. But the big takeaway that I have are that, one, relationships are key…

1:01:00.4 MC: Yes. Absolutely.

1:01:00.7 MB: And in the same way many of us go to find a doctor, we need to go find a banker, ’cause this whole concept of a financial health check-up is huge. Because it allows us to know how we’re doing in the process, and if something were to go sideways, or we need something, we know what our options are, we know what those opportunities are, and that’s huge. And this idea of looking at financial institutions as a learning opportunities with the webinars or just being able to talk to people, which I will say, you know, even… Well, I got a few coins… Until I met you, I didn’t even know that. And I would say that, my intention of picking you in particular was because I think having those relationships is key. I have been…

1:01:44.2 MC: Thank you.

1:01:45.0 MB: With a bank, I’m now with you all too. But with a bank for over 20 something years, and I’m not sure anybody even knows who the heck I am, and I picked them because they were my neighborhood bank when I lived in New York, and then once I left, I was like, well, that person’s gone and then everything became an app and they were like, “Well, we can’t even forget… ” I call the manager, nobody answers. And so I do think that in this world of technology, what heartens me is that while there’s lots of things happening with algorithms when you pass it off, there is still a role for someone to advocate for us. And I just wanna say how deeply grateful I am that you advocate for me and our organization and most importantly our entrepreneurs on a daily basis. ‘Cause I have called you and said, “Girl, you’ve worked some miracles,” ’cause I don’t know if I would have made that loan, so I am deeply grateful to you for being a…

1:02:28.6 MC: Thank you.

1:02:29.0 MB: Frontline economic responder all the time…

[laughter]

1:02:31.7 MB: And not just during COVID. And I trust that this conversation is useful to people, I’m sure people are gonna be calling you…

[laughter]

1:02:37.6 MC: I hope so.

1:02:37.7 MB: But it’s helpful to just kind of demystify this process and to not be afraid of a bank because it is nothing more but another tool in the tool kit for us to grow our businesses.

1:02:49.0 MC: Well, thank you, Melissa. I feel privileged being here…

1:02:53.4 MB: Yes. Thank you.

1:02:53.8 MC: Thank you for having me.

1:02:56.1 MB: Of course. Hey, I got a banker I like, so I’m definitely gonna invite you.

[laughter]

1:03:00.1 MB: Thank you, ma’am, appreciate you.

[music]

1:03:03.1 MB: Today’s lesson on your journey from founder to CEO ironically did not come from a founder, but it came from MBallou, who defined herself as our frontline economic responder, and boy do we need her. She demonstrated all the things that oftentimes we were afraid to ask, she noted that investors and bankers understand that this is a relationship and that both sides need to make time and build trust. She let us know that it’s okay for us to be transparent and to share what our dreams are, and to be honest at the forefront so that a banker is there not just to keep saying no, but to be partnering with us on our financial health check-ups on a regular basis. It’s important that we do not let the fear that oftentimes comes into our mind when we talk about capital and banks and investors, and that we focus on creating a relationship.

1:04:00.5 MB: But to me, the most important lesson that MBallou provided was that our finances are not something that we should be afraid of, but it’s something that we should actually embrace. That if we do not take the time to invest in ourselves, which means addressing our fears, honing in on opportunity and putting aside all the negative narratives that run into our mind, if we don’t do that, it’s pretty darn hard to ask anybody else to invest in us. Now, trust me, I know that’s hard, because most of the time when we start businesses, people tell us it’s the dumbest idea they ever had, that’s not gonna work, etcetera. But we need to step out on faith and trust and know that there are many more bankers across the United States, like MBallou, who are gonna be there to take care of us, to help us with our finances.

1:04:49.0 MB: So like she said, “Don’t wait to get what you need when you need it, go out there.” And I trust that you will find somebody who’s interested in being a partner and being in a positive relationship with you to be able to help you and your business, not just survive, but also thrive. So remember, get your financial health check-up, get your frontline economic responder and get on that pathway to personal and business financial success.

[music]

Thank you for listening.

To learn more about the Beyond Five initiative, including their survivability report, go to founderhustle.io.

[music]

1:05:31.3 MB: Don’t forget to subscribe and feel free to give us five stars. We’ll put a link to a blog post about this episode in the show notes. The blog will be full of tidbits mentioned throughout the episode, information on our guests and anything else we think feels right and is needed for your entrepreneurial journey. For additional information on our guests and links to their businesses, please go to our site, founderhustle.io. And while you’re there, download the resource guides provided by 1863 ventures. I promise you, they will empower you with practical tools and advice. You can find us on Twitter @founderhustle, on Instagram, we’re underscore founderhustle, and if you’re a Facebook person, we’re also there as Founder Hustle. Founder Hustle is produced by Kinetic Energy Entertainment. Associate Producer is Misa Dayson. The show was edited and mixed by Ann Kane. Social media producer is Misako Envela. Our intro theme, Vuelta al Sol is by Tomás Novoa. Credit theme is Glide, by Columbia Nights, and the outro is Ratata by Curtis Cole. Founder Hustle was recorded at Clean Cuts in Washington DC. .

And to all the founders out there, remember to find your financial first responder.

[music]

1:06:53.3 DWProducer: Okay, so a couple of things I’d like to dig into…

1:06:58.0 MB: I know you would. I gave her… I gave her the heads up.

[laughter]

1:07:01.2 MB: I knew you would. Okay.

[laughter]

1:07:04.0 DWProducer: First of all, this was great, I’m gonna get my credit report.

[laughter]

1:07:09.4 DWProducer: Look I got mine last little… Oh, gosh, nine years ago, so time had changed…

1:07:14.7 MB: Come on, Diana, come on.

[music]

Referenced in Today’s Episode:

- M&T Bank Outlines $43 Billion Community Growth Plan To Support Underserved, Communities of Color and Small Businesses (Oct. 2021)

- The Road to Zero Wealth: How the Racial Wealth Divide is Hollowing Out America’s Middle Class (Prosperity Now / September 2017)

- Black and Latino Households Are on a Path to Owning Zero Wealth (Prosperity Now / September 12, 2017)

- SBA – Learning Platform

- SWOT Analysis (Investopedia)

- Founder Hustle is produced by Kinetic Energy Entertainment.

- Associate Producer is Misa Dayson.

- The show was edited and mixed by Ann Kane.

- Social media producer is Misako Envela.

- Our intro theme, Vuelta al Sol is by Tomás Novoa.

- Credit theme is Glide, by Columbia Nights, and the outro is Ratata by Curtis Cole.